Beth taps her phone at a pay terminal, initiating a seamless and secure transaction that exemplifies the transformative power of contactless payments. This innovative technology has revolutionized the way we make purchases, offering unparalleled convenience, enhanced security, and a glimpse into the future of financial transactions.

As mobile payment technologies continue to proliferate, pay terminals are evolving to meet the demands of a tech-savvy consumer base. This comprehensive guide explores the intricacies of pay terminals, mobile payment technologies, and the benefits and challenges associated with contactless payments, providing valuable insights for businesses and consumers alike.

Pay Terminal Overview

Pay terminals, also known as point-of-sale (POS) systems, are electronic devices that enable merchants to accept payments from customers. They play a crucial role in facilitating seamless and secure transactions in various industries.

Pay terminals come in different types, each with its own set of features and capabilities. Some common types include:

- Standalone terminals:These are self-contained units that do not require a connection to a computer or network.

- PC-based terminals:These terminals are connected to a computer and rely on software to process transactions.

- Mobile terminals:These terminals are designed for use with mobile devices, such as smartphones and tablets.

Pay terminals are widely used in a variety of locations, including retail stores, restaurants, hotels, and transportation hubs. They provide merchants with a convenient and efficient way to accept payments, track sales, and manage inventory.

Mobile Payment Technologies

Mobile payment technologies have revolutionized the way people make payments. These technologies allow customers to use their mobile devices to pay for goods and services.

There are several different mobile payment technologies available, including:

- Contactless payments:These payments are made by tapping a mobile device on a compatible payment terminal.

- NFC payments:These payments are made using near-field communication (NFC) technology, which allows devices to communicate with each other when they are in close proximity.

- QR code payments:These payments are made by scanning a QR code with a mobile device.

Mobile payment technologies work seamlessly with pay terminals. When a customer uses a mobile payment app to make a purchase, the app sends the payment information to the pay terminal. The terminal then processes the transaction and sends a confirmation to the customer’s device.

The adoption of mobile payments has been growing rapidly in recent years. According to a study by Statista, the global mobile payment market is expected to reach $13.1 trillion by 2027.

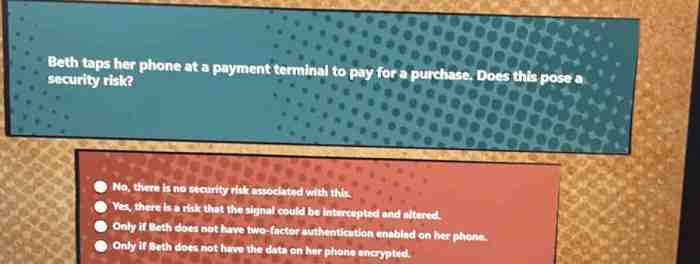

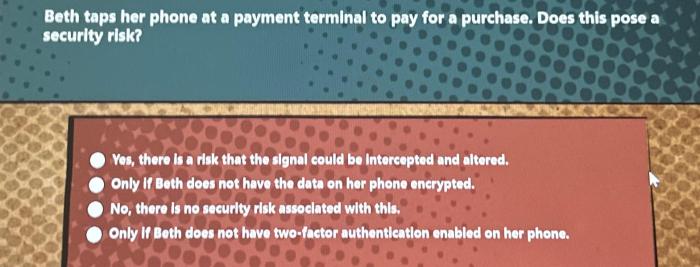

Security Considerations

While pay terminals and mobile payment technologies offer convenience and efficiency, they also pose potential security risks.

Some of the most common security risks associated with using pay terminals include:

- Skimming:This is a type of fraud where criminals use a device to steal credit card information from a pay terminal.

- Data breaches:These occur when hackers gain unauthorized access to the data stored on a pay terminal.

- Malware:This is a type of malicious software that can infect pay terminals and steal customer data.

To protect against these risks, pay terminals and mobile payment technologies implement a variety of security measures, including:

- Encryption:This is a process that scrambles data so that it cannot be read by unauthorized individuals.

- Tokenization:This is a process that replaces sensitive data with a unique token that can be used to process transactions without exposing the underlying data.

- EMV chip technology:This is a type of chip-based technology that makes it more difficult for criminals to counterfeit credit cards.

In addition to these security measures, it is important for merchants and customers to follow best practices when using pay terminals and mobile payment technologies. These best practices include:

- Using strong passwords:This helps to protect against unauthorized access to pay terminals and mobile payment apps.

- Being aware of your surroundings:This helps to prevent criminals from skimming your credit card or stealing your mobile device.

- Reporting suspicious activity:If you notice anything suspicious, such as a damaged pay terminal or a strange device attached to a pay terminal, report it to the merchant or your bank immediately.

Benefits of Contactless Payments

Contactless payments offer several advantages over traditional methods of payment, such as cash or credit cards.

Some of the benefits of contactless payments include:

- Convenience:Contactless payments are quick and easy to make. Customers simply need to tap their mobile device or credit card on a compatible payment terminal.

- Security:Contactless payments are more secure than traditional methods of payment. They use encryption and tokenization to protect customer data.

- Hygiene:Contactless payments eliminate the need to touch cash or credit cards, which can help to reduce the spread of germs.

Contactless payments are particularly beneficial in industries where speed and convenience are essential, such as:

- Retail:Contactless payments allow customers to make purchases quickly and easily, without having to wait in line to pay.

- Transportation:Contactless payments allow commuters to pay for fares quickly and easily, without having to fumble with cash or credit cards.

- Hospitality:Contactless payments allow guests to pay for meals and drinks quickly and easily, without having to wait for a server to bring them a bill.

Contactless payments also contribute to a more efficient and seamless user experience. They eliminate the need for customers to carry cash or credit cards, and they reduce the amount of time spent waiting in line to pay.

Challenges and Limitations: Beth Taps Her Phone At A Pay Terminal

While contactless payments offer several advantages, they also face some challenges and limitations.

Some of the challenges and limitations associated with contactless payments include:

- Compatibility:Contactless payments require both a compatible payment terminal and a compatible mobile device or credit card.

- Security:While contactless payments are more secure than traditional methods of payment, they are not completely immune to fraud. Criminals have developed new techniques to steal data from contactless payment devices.

- Cost:Contactless payment terminals can be more expensive than traditional payment terminals.

Contactless payments may not be feasible or suitable in all scenarios.

Some scenarios where contactless payments may not be feasible or suitable include:

- High-value transactions:Contactless payments are typically limited to low-value transactions. For high-value transactions, merchants may require customers to use a traditional method of payment, such as a credit card or cash.

- Offline transactions:Contactless payments require a network connection to process transactions. In areas where there is no network connection, contactless payments may not be possible.

Despite these challenges and limitations, contactless payments are becoming increasingly popular. As the technology continues to evolve, these challenges and limitations are likely to be overcome.

Future Trends

Contactless payment technologies are constantly evolving to meet the changing needs of consumers and businesses.

Some of the emerging trends in contactless payment technologies include:

- Biometric payments:These payments use biometric data, such as fingerprints or facial recognition, to authenticate transactions.

- Mobile wallets:These apps allow users to store their credit cards and other payment information on their mobile devices. Mobile wallets can be used to make contactless payments at any compatible payment terminal.

- Blockchain technology:Blockchain technology can be used to create secure and transparent payment systems.

These emerging trends are likely to shape the future of contactless payments. They have the potential to make contactless payments even more convenient, secure, and efficient.

Detailed FAQs

What are the benefits of using contactless payments?

Contactless payments offer numerous advantages, including increased convenience, enhanced security, faster transaction times, and improved hygiene.

Are contactless payments secure?

Yes, contactless payments are generally secure, utilizing encryption and tokenization technologies to protect user data. However, it is essential to practice good security habits, such as keeping your mobile device and payment information up to date.

What are the limitations of contactless payments?

Contactless payments may not be feasible in all scenarios, such as when the transaction amount exceeds a certain limit or when the pay terminal does not support contactless technology.